In today’s digital age, cyber threats are a constant and evolving risk for businesses of all sizes. Cyber insurance has emerged as a crucial tool for mitigating these risks, providing financial protection and support in the event of a cyber incident. This comprehensive guide will explain what cyber insurance is, why it is essential, and how to choose the best policy to protect your digital assets in 2024.

What is Cyber Insurance?

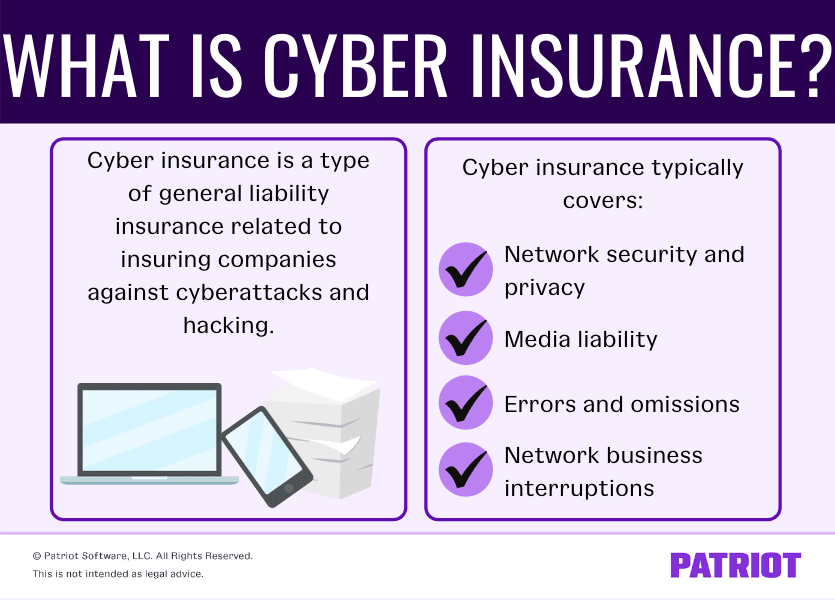

Cyber insurance, also known as cyber liability insurance or cybersecurity insurance, is a specialized insurance product designed to protect businesses and individuals from internet-based risks. These risks include data breaches, ransomware attacks, phishing, and other cyber threats. Cyber insurance policies typically cover both first-party and third-party losses.

First-Party Coverage

First-party coverage includes costs directly incurred by the insured due to a cyber incident. This can cover:

- Data Destruction and Restoration: Costs associated with recovering and restoring lost or stolen data.

- Business Interruption: Compensation for lost income due to a cyber attack that disrupts business operations.

- Cyber Extortion: Payments made to resolve ransomware attacks or other forms of cyber extortion.

- Incident Response: Expenses for forensic investigations, legal fees, and public relations efforts to manage the fallout from a cyber incident.

Third-Party Coverage

Third-party coverage protects businesses from claims made by others affected by a cyber incident. This can include:

- Legal Fees and Settlements: Costs associated with defending against lawsuits and paying settlements or judgments.

- Regulatory Fines: Penalties imposed by regulatory bodies for failing to protect sensitive data.

- Privacy Liability: Claims related to the unauthorized access or disclosure of personal information.

Why is Cyber Insurance Important?

The importance of cyber insurance cannot be overstated in today’s interconnected world. Here are some key reasons why businesses should consider investing in cyber insurance:

Financial Protection

Cyber incidents can result in significant financial losses. For example, the average cost of a data breach in 2023 was $4.24 million, according to IBM. Cyber insurance provides financial protection by covering the costs associated with these incidents, including data recovery, business interruption, and legal fees.

Legal and Regulatory Compliance

Many industries are subject to strict data protection regulations, such as the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Cyber insurance can help businesses comply with these regulations by covering the costs of legal defense and regulatory fines.

Risk Management

Cyber insurance encourages businesses to adopt stronger cybersecurity practices. Insurers often require policyholders to implement specific security measures, such as multi-factor authentication and regular security audits, to qualify for coverage. This proactive approach helps reduce the likelihood of a cyber incident occurring in the first place.

Peace of Mind

Knowing that your business is protected against cyber risks can provide peace of mind. Cyber insurance allows businesses to focus on their core operations without constantly worrying about the potential financial and reputational consequences of a cyber attack.

Types of Cyber Insurance Coverage

Cyber insurance policies can vary widely in terms of coverage and exclusions. Here are some common types of coverage to look for when selecting a policy:

1. Privacy Liability Coverage

Privacy liability coverage protects businesses from liabilities resulting from the unauthorized access or disclosure of personal information. This includes costs related to privacy law violations, regulatory investigations, and consumer class-action lawsuits.

2. Network Security Coverage

Network security coverage protects businesses from losses resulting from network security failures, such as data breaches, malware infections, and ransomware attacks. This coverage typically includes costs for IT forensics, legal expenses, data restoration, and breach notification.

3. Business Interruption Coverage

Business interruption coverage compensates businesses for lost income and additional expenses incurred due to a cyber incident that disrupts operations. This can include losses from system failures, human error, or third-party hacks.

4. Cyber Extortion Coverage

Cyber extortion coverage protects businesses from ransomware attacks and other forms of cyber extortion. This coverage typically includes payments to resolve extortion demands and costs for negotiating with cybercriminals.

5. Media Liability Coverage

Media liability coverage protects businesses from claims related to intellectual property infringement, defamation, and other media-related liabilities. This coverage is particularly important for businesses that rely heavily on digital content and online advertising.

6. Errors and Omissions Coverage

Errors and omissions (E&O) coverage protects businesses from claims related to errors or performance failures in their services. This can include claims of negligence, breach of contract, and failure to deliver services as promised.

How to Choose the Right Cyber Insurance Policy

Selecting the right cyber insurance policy requires careful consideration of your business’s unique needs and risks. Here are some key factors to consider when choosing a policy:

Assess Your Cyber Risks

Start by conducting a thorough assessment of your business’s cyber risks. Identify the types of data you handle, the potential impact of a cyber incident, and the vulnerabilities in your current security measures. This assessment will help you determine the level of coverage you need.

Compare Coverage Options

Not all cyber insurance policies are created equal. Compare the coverage options offered by different insurers to ensure you get the protection you need. Look for policies that include comprehensive first-party and third-party coverage, as well as additional benefits like incident response and legal support.

Evaluate Policy Limits and Deductibles

Review the policy limits and deductibles to ensure they align with your business’s financial capabilities. Higher policy limits provide more extensive coverage but may come with higher premiums. Similarly, higher deductibles can lower your premiums but require you to pay more out-of-pocket in the event of a claim.

Consider the Insurer’s Reputation

Choose an insurer with a strong reputation for customer service and claims handling. Research customer reviews, testimonials, and industry ratings to gauge the insurer’s reliability and responsiveness. A reputable insurer will provide the support you need during a cyber incident.

Look for Risk Management Support

Many insurers offer risk management support to help businesses improve their cybersecurity posture. This can include services like vulnerability assessments, employee training, and security audits. Look for policies that include these proactive measures to help prevent cyber incidents.

Understand Policy Exclusions

Carefully review the policy exclusions to understand what is not covered. Common exclusions may include losses resulting from human error, pre-existing vulnerabilities, and acts of war. Ensure that the exclusions align with your risk profile and that any potential gaps in coverage are addressed.

Top Cyber Insurance Companies in 2024

Based on industry research and expert evaluations, here are some of the top cyber insurance companies in 2024:

1. Chubb

Chubb is a global leader in cyber insurance, offering comprehensive coverage options and exceptional customer service. Their policies include extensive first-party and third-party coverage, as well as risk management support and incident response services.

2. AIG

AIG is known for its robust cyber insurance solutions, providing coverage for a wide range of cyber risks. Their policies include first-party and third-party coverage, as well as additional benefits like cyber extortion coverage and business interruption protection.

3. Beazley

Beazley is a specialist insurer with a strong focus on cyber risk. Their policies offer comprehensive coverage for data breaches, ransomware attacks, and other cyber incidents. Beazley also provides extensive risk management support and incident response services.

4. Travelers

Travelers offers flexible cyber insurance policies tailored to the needs of businesses in various industries. Their coverage includes first-party and third-party protection, as well as additional benefits like social engineering fraud coverage and business interruption protection.

5. Zurich

Zurich is a well-established insurer with a strong reputation for providing comprehensive cyber liability coverage. Their policies include protection against data breaches, cyber extortion, and business interruption, as well as risk management support and incident response services.

6. AXA XL

AXA XL is a leading provider of cyber insurance for financial institutions and other high-risk industries. Their policies offer extensive first-party and third-party coverage, as well as additional benefits like regulatory defense and penalties coverage.

7. Coalition

Coalition offers innovative cyber insurance solutions with a focus on proactive risk management. Their policies include comprehensive coverage for data breaches, ransomware attacks, and business interruption, as well as access to security tools and resources to help prevent cyber incidents.

8. CFC Underwriting

CFC Underwriting is known for its flexible cyber insurance policies and exceptional customer service. Their coverage includes first-party and third-party protection, as well as additional benefits like cyber extortion coverage and business interruption protection.

9. Hiscox

Hiscox offers tailored cyber insurance solutions for small and medium-sized businesses. Their policies include comprehensive coverage for data breaches, ransomware attacks, and business interruption, as well as risk management support and incident response services.

10. Tokio Marine HCC

Tokio Marine HCC provides specialized cyber insurance solutions with a focus on professional liability and reinsurance products. Their policies offer extensive first-party and third-party coverage, as well as additional benefits like regulatory defense and penalties coverage.

Conclusion

In an increasingly digital world, cyber insurance is essential for protecting your business from the financial and reputational consequences of cyber incidents. By understanding the types of coverage available, assessing your cyber risks, and choosing the right policy, you can ensure that your digital assets are well-protected in 2024 and beyond.Investing in cyber insurance not only provides financial protection but also encourages stronger cybersecurity practices, helping to prevent cyber incidents before they occur. With the right coverage in place, you can focus on your core business operations with confidence, knowing that you are prepared for whatever cyber threats may come your way.